The Piper Called...

....He Wants to be Paid

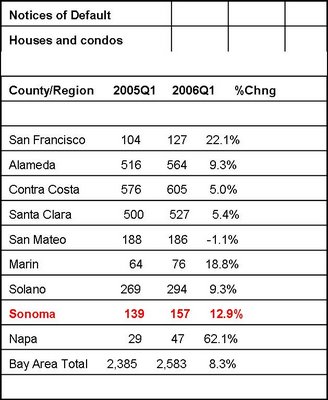

(From Inman News) "First-quarter foreclosure activity in California increased to the highest level in more than two years, the result of slower home-price increases, a real estate information service reported."

"Lending institutions sent 18,668 default notices to California homeowners during the January-to-March period. That was up 23.4 percent from 15,122 for the prior quarter, and up 28.7 percent from 14,501 for 2005's first quarter, according to DataQuick Information Systems."

'"A number of factors are driving defaults higher," said Marshall Prentice, DataQuick's president."

'"The main one right now is that home values are rising more slowly than they have been the past couple of years, which makes it more difficult for homeowners to sell their homes and pay off the lender. Other factors that influence default activity include the amount of equity people have in their property, the type of mortgage they used and how long they've had that mortgage."'

In 2005 nearly 70% of home sales were purchased using ARMs and more than 50% were Interest Only.

That is nearly twice the national rate and more than every Bay Area County except San Fancisco

"The median first-quarter default amount on a primary mortgage last quarter was $9,220 on a loan of $280,000. On second mortgages and lines of credit the median amount owed was $3,386 on a loan of $56,760."

Per capita income in Sonoma County in 2005 was $37,384 and had gone down from 2004 and was expected to raise by about $2000 for 2006.

9 Comments:

Wow! Look at that Napa figure.

And that Marin figure...that can't be right. All the Marin RE bulls assure me that Marinites are all rich, making high salaries, and are financially savvy. So that just can't be right. ;)

That Napa figure astounded me. I have heard NOTHING about their troubles... other than the daughter of the RE Agent who told the housing bull in her class that prices were coming down and the market was crashing and wouldn't be coming back up until they were out of college... maybe I oughta start poking my nose around.

Yuba is up over 100%

Whoaa! I guess a few put themselves on a limb for a taste of Napa's bon vivant. I could be wrong, but I suspect people are more tempted to get themselves FB'd to live somewhere with cachet.

You know, I think Napa has a little less cachet than sonoma. What's that saying? Napa makes auto parts and Sonoma makes wine....

Anyway, I will see about doing some digging on the borrower and home owner profile in Napa... my hunch is that being it is largely a blue collar, and state and county worker economy...I bet these FB's are simply those who over-extended due to prices rising out of bounds from wages. But some data will be needed to validate that hunch.

You know, the people default now due to rate resets got their loans around 2003. In 2005 70% loans were ARMs or worse. So 2007-8 should be quite a show as far as defaults are concerned.

this is just the start,the first real surge in arm resets starts in june,yeehaw and hold onto your hats!! if you pause to think of all those "stated income" borrowers who "fudged"their income with the active encouragement of the lenders and loan brokers...it will be special,"no,you can't go bankrupt,you committed mortgage fraud,a felony" "why should we forgive your loan,you criminal?"but the loan officer said i needed to show the income to qualify,i,i,i'll sue!!!" uuurrk. i just love it when i hear "tom you and i are honest men ,let's cheat..."

How long before those mortgage brokers proudly boasting that 80% of their customers are in Neg-AM mortgages start pulling their headshots out of the newspapers? I wonder how many will trade in those headshot ads for mugshots?

Post a Comment

Subscribe to Post Comments [Atom]

<< Home