Sonoma So Over?

Sonoma County and the Bay Area are near the top of the PMI risk index for home price declines over the next two years. The index tracks prices, affordability and jobs to determine chances for price declines in the nation's metropolitan areas.

"The last year things have been moving up quite a bit," Van Akkeren said.

The latest PMI index projects a 45 percent chance for a price decline in Sonoma County over the next two years. The Bay Area has a nearly 48 percent chance for a price decline.

As Sonoma County's housing market eases from record heights, the past year will be remembered as the time when sales and prices peaked after a remarkable seven-year run.

Year-end sales reports cap a year that saw rising mortgage rates and sinking affordability trigger a slowdown that had been predicted for two years.

"It was great, a fabulous year. It was different than any other market I've been through in 36 years. It kept climbing for so long," said Beth Robertson, a broker with Century 21 Classic Properties, in Rohnert Park. "Now it's flattening."

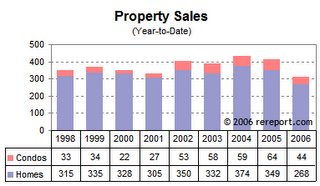

For 2005, Sonoma County home sales fell short of the 6,000 mark for the first time since 2001.

"As buyers stepped back from the bargaining table sales slowed," said Rick Laws, Santa Rosa manager for Coldwell Banker."As a whole, 2005 was the peak of the market.

The key thing for the market is rates started to go up finally," said Leslie Appleton-Young, chief economist for the California Association of Realtors.

The time it takes from when a home is listed to when it is put under contract has risen rapidly in the past four months and is now at 90, the highest level since February 2002.

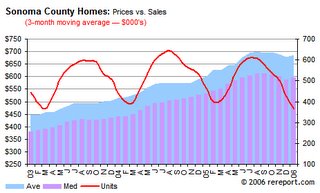

The median price for single-family homes in Sonoma County soared 7.2% to $614,00 in January from the month before, a year-over-year gain of 14.8%. This is only $4,450 short of the record high set last August.

Conversely, home sales sank 29.7% from the month before and were off 23.2% year-over-year. That's four months in a row home sales have been off by double-digits from the year before. Not only that, the 268 homes sold were the lowest single monthly total since January 1998!

The sales price to list price ratio for single-family home fell one half point to 97.5%, continuing the downward trend that was interrupted in December. The condo ratio dropped 0.4 of a point to 99%.

Affordability sunk to record lows as prices rose to new heights. While the percentage of households that could afford to buy a home had been declining, it dropped significantly over the past year.

Only 7 percent of households could afford a median-priced home in Sonoma County at year's end compared with 12 percent a year ago.

A Sonoma County household needed a minimum income of $152,595 to buy the typical home, based on prevailing interest rates for a 30-year mortgage. A year ago, the minimum income needed was $124,650.

Buyers had to increasingly stretch financially to purchase homes. A majority turned to interest-only and other adjustable-rate loans, often making little or no down payment when purchasing homes.

Adjustable-rate mortgages accounted for 69 percent of loans to buy Sonoma County homes last year and only 31 percent were 30-year, fixed-interest loans - a reversal from just two years earlier.

Interest-only and loans with a monthly range of payment options offer lower monthly mortgage payments. Owners count on short-term price gains from the market to build equity in homes and then refinance or sell, often within three to five years.

"We had ready availability of significant below-market-rate financing," Appleton-Young said. "If the mail I get at home is any indication, the lending community has been fairly aggressive at advertising them.

"Relying on the housing market to build value works when appreciation is strong. But if prices drop, homeowners might end up owing more than a home is worth.

Prices dipped in September and October 2005 as sales dropped due to rising interest rates and increasingly cautious buyers. Homes stayed on the market longer and supplies built back up to three-year highs. Sales slowed due to affordability concerns among more buyers, Robertson said."There's a huge desire still to buy a home in Sonoma County. It's just the prices have gotten unreachable," she said.

Sellers accustomed to bidding battles now face having to cut prices some and negotiating more with buyers. Credits for repairs, longer inspection and escrow periods, and even paying closing costs are indicators that the buyers have more leverage.

"The market has leveled off and is starting to go the other way. I'm confident that the sellers will negotiate more," Jeanne Delario of Coldwell Banker said.

Also: From Dan Gillmor's place

"Marketwatch: Getting in at any price. Homebuyers increasingly approach home loans much the way consumers buy cars, shopping for the lowest possible monthly payment to avoid being left out cold on the housing-boom sidewalk. But the explosion of such products, a sign of looser lending standards, suggests many consumers are taking on complex loans without fully understanding the risks they face when interest rates rise in the future, some analysts say. And that could pose a ripple effect in overheated real estate markets.

See also, from the Washington Post, "It's on the house,", an article about the dangerous trend in which "everybody is paying for everything with (borrowing on) home equity" -- and we, the taxpayers, subsidize this. The home mortgage interest tax deduction is a questionable policy to begin with, but we turn that into a subsidy of totally unrelated spending by extending the deduction to loans on equity for spending that has nothing whatever to do with home ownership.

We are less a nation of risktakers than a culture of reckless spendthrifts."

7 Comments:

I was talking to one of my neighbors yesterday about the future of RE here in Sonoma. This is one of my up up and away neighbors..(is there any other kind?) He kept saying that the reason things will never go down here is that there are so many wealthy people out there just waiting to buy, and they can afford anything.

I explained to him that just because someone has money it doesn't mean it's burning a hole in their pocket. In fact the reason that they have money is probably due to foresight and self control in the "I want" department. After all why should any self respecting wealthy person shell out now, with all the bargains just around the corner. He just said..O!

The thing is in Sonoma so many bought thinking it was a sure thing and they could flip it to those who feared being priced out of the market.

Property values were still fairly reasonable as early as 2000 and 2001 but the telecom tech boom of companies moving out of silicon valley because it was too hard to recruit people changed the landscape. They began moving in and bringing a workforce with them that wanted a better quality of life. Not to mention if they moved them there, the liklihood of them giving it all up and moving back to SillyValley was pretty low... um.. as long as the jobs held out. It was a retention tactic and a pretty good one.

That being said, at that time- the late 90's and early 2000's there was still significant price disparity between Sonoma County and the greater Bay Area and Silly Valley. I actually was interviewing a Director for one of the tech companies and he asked me seriously (in 1999) if I had any insight into some property he could buy. Because he sold his SF house for $750k but he couldn't find anything expensive enough in Sonoma County to roll the money back into.

He was not alone... more and more workers moved North from SF and Silly Valley homes and found themselves in the same boat.

A Flipping Revolution was born, and these sorts of folks bought multiple houses. The property values climbed. The media smelled a story, the teeming masses caught on and the race was on.

Those relocating from higher property value areas were still in control though, because while there were a handful of companies offering Silicon Valley Salaries the rest of the jobs in Sonoma County were still for service workers, blue collars, and of course the burgeoning real estate and construction industry that was the benefactor of the speculators.

Sonoma Valley itself is quaint and small and was vulnerable to the uniqueness sell... the limited availability of property- and they began consumming large quantities of the supply and demand Kool-Aid.

For a while there, there actually were people who followed the newbies and speculators into the market and benefitted from a couple year's worth of equity in houses they bought late 90's and 2000 and 2001... those people wanted to be the next investors and some traded up, and some bought ahem... "investment properties"

Then in the last two years you can see the trend of those who WANTED to at least FEEL wealthy and get into the market. They saw the easy killings so many others appeared to be making and they set out to bag their own exotic, erotic loan and sell their very souls to the lenders.

In the last year alone- the properties sold were 69% I/O ARM loans... that should tell any intelligent person right there, that the last round of buyers were not wealthy people with money burning a hole in their pocket just waiting to get into the market.

They were chumps who had no money but were banking on the entitlement that real estate only goes up, and all they had to do was sign on the dotted line, and voila they too would own their very own houseATM.

I have a good friend who sounds a lot like your friend. he rushed in and bought a year and a half ago- and he told me that he couldn't wait to get into the market, and sadly he is still drinking from the stupid cup.

He actually told me that it is a great idea to go get an 800k nothing down loan to buy a converted chicken coop on the east side.

My question was seriously, why would I do that? Who would justify the monthly costs of a house that 4 years ago was only worth $200k if that? Further, where was the price going to go? Who was going to come along and buy that little cottage/chicken coop for MORE than $800k? Don't you see that the price is already ridiculous and artifically supported?

His answer: Supply and Demand- people want to live here, and real estate is only going up. may as well get in now before you can't get in.

WTF?

Wall Street Window Says Real Estate Problems Ahead.

Mike Swanson and WallStreetWindow

Yes, there is a housing bubble!

Yesterday morning I took my car to get worked on. They gave me a loaner, so while I waited I drove to the nearby Borders Book store. When I got there, I made my usual bee-line for the business/financial section.

Two years ago, there were two full rows of stock market books in this store. Now there was only a half a row. However, there are now almost two full rows of books telling you how to get rich buying real estate. They included titles such as Real Estate Miracles, Why Real Estate Will Go Up in Value for 10 Years, The Baby Boomer Vacation Real Estate Boom, The Weekend Millionaire’s Secrets to Investing in Real Estate: How to Become Wealthy in Your Spare Time, Flipping Properties: Generate Instant Cash Profits in Real Estate, How to Buy Real Estate and Walk Away with Cash, and the aptly titled Real Estate for Dummies.

Judging by what I see in this book store it would seem that the masses have grown disinterested in stock speculation and are trying their hand at being real estate moguls. Of course, I’ve read stories and facts to this effect, but now I am seeing evidence of this myself.

A couple of weeks ago, I talked with a guy who lives in New Jersey. He told me that his house has more than doubled in value in the past 5 years. He bought it for less than $300,000. His neighbor across the street put his home up for sale - came over to his house - and asked him to put his house up for sale for a million. He doesn’t want to move and his neighbor knows that, but the neighbor thinks a high asking price on one house will allow him to make more money when someone buys his.

The Myrtle Beach area is booming. One gentleman I know who believed “new economy” stocks such as Cisco and Oracle would make him rich until he got burned on them, is now investing in Myrtle Beach vacation condos. He bought one before it was built at $150,000. It hasn’t even been completed yet and he can sell it now at $250,000. As a rule of thumb a real estate investment is considered a good buy if you can purchase it at 100 times what you can get for a monthly rental payment. These Myrtle Beach properties are now going at almost twice that.

The only reason people are buying these Myrtle Beach properties is for the appreciation. It isn’t a rental investment for these people. And when I told this guy that he is seeing the tail end of a bubble, he said maybe so - but he can’t believe it can go down much because the baby boomers are going to retire and won’t stop buying the properties.

Perhaps, but what has really fueled the real estate craze is the low rate of interest Alan Greenspan has given us. Even the Federal Reserve is starting to believe that real estate is getting out of hand. Minutes of the December FOMC meeting revealed:

“Some participants believed that the prolonged period of policy accommodation had generated a significant degree of liquidity that might be contributing to signs of potentially excessive risk-taking in financial markets evidenced by quite narrow credit spreads, a pickup in initial public offerings, an upturn in mergers and acquisition activity, and anecdotal reports that speculative demands were becoming apparent in the markets for single-family homes and condominiums.”

In his recent testimony to Congress about the economy, Alan Greenspan pointed out that rising real estate values have kept consumer spending going and have contributed to our low national savings rate. He said:

“The sizable gains in consumer spending of recent years have been accompanied by a drop in the personal saving rate to an average of only 1 percent over 2004--a very low figure relative to the nearly 7 percent rate averaged over the previous three decades. Among the factors contributing to the strength of spending and the decline in saving have been developments in housing markets and home finance that have spurred rising household wealth and allowed greater access to that wealth. The rapid rise in home prices over the past several years has provided households with considerable capital gains. Moreover, a significant increase in the rate of single-family home turnover has meant that many consumers have been able to realize gains from the sale of their homes. To be sure, such capital gains, largely realized through an increase in mortgage debt on the home, do not increase the pool of national savings available to finance new capital investment. But from the perspective of an individual household, cash realized from capital gains has the same spending power as cash from any other source. “

“More broadly, rising home prices along with higher equity prices have outpaced the rise in household, largely mortgage, debt and have pushed up household net worth to about 5-1/2 times disposable income by the end of last year. Although the ratio of net worth to income is well below the peak attained in 1999, it remains above the long-term historical average. These gains in net worth help to explain why households in the aggregate do not appear uncomfortable with their financial position even though their reported personal saving rate is negligible. “

“Of course, household net worth may not continue to rise relative to income, and some reversal in that ratio is not out of the question. If that were to occur, households would probably perceive the need to save more out of current income; the personal saving rate would accordingly rise, and consumer spending would slow. “

I believe that the FOMC minutes and Alan Greenspan's recent statements demonstrate that the Federal Reserve is worried about the real estate market. They saw what effects the fallout of a stock market bubble had on the economy and are most likely worried that the implosion of a real estate bubble would have similar - if not worse - consequences.

Under Alan Greenspan’s tutelage, the Fed almost always acts in panic and overreacts. In the 1990’s, he lowered interest rates too low - and kept them low for too long - in reaction to several global economic crises. At the end of 1999, he printed money like a madman in fear of the phantom Y2K computer crisis. He thereby created a stock market bubble. When that bubble began to unwind he lowered interest rates to 50 year lows in fear that that process would create a deflationary depression. Now it seems that the Fed is worried that the housing market is getting too hot, because they have kept interest rates so low.

We have come full circle. Remember in 2000 Greenspan promised to create a “soft landing” for the economy and stock market? Now he is trying to do something similar - for real estate - and more importantly the dollar.

I have stated for several years that the biggest danger to our economy is the current account deficit. In this speech, Greenspan also said that it “will be essential” to “address our current account deficit without significant disruption. Besides market pressures, which appear poised to stabilize and over the longer run possibly to decrease the U.S. current account deficit and its attendant financing requirements, some forces in the domestic U.S. economy seem about to head in the same direction. Central to that adjustment must be an increase in net national saving. This serves to underscore the imperative to restore fiscal discipline.”

Greenspan is trying to increase the national savings rate and dampen down speculation by raising interest rates. It is a tough thing to get just right. The key will be what happens with the dollar and long-term bond yields. If the adjustment doesn’t go orderly then the dollar will break its 80 support level and fall rapidly, setting off a panic that will cause long-term interest rates to shoot up quickly. Such a move would set off a chain reaction in the economy, causing the stock market to drop, real estate values in hot speculative markets to collapse, and consumer spending to slow down. In the end, all of these things would eventually lead to a higher savings rate and get the current account deficit in order, thereby paving the ground for the next boom - but it would be a very bumpy process.

If Greenspan has proven anything it is that it is very difficult to perfectly manipulate and control a financial market. When the Nasdaq was at 5,000 people praised Greenspan as a genius, but the years since then has proven how difficult - and foolhardly - it is to try to bend the economy and the behavior of investors all over the world to your will through moving interest rates around and printing money.

The problem is that when you manipulate a market there are winners and losers. And the losers won’t just sit on their hands. Will my buddy invested in Myrtle Beach real estate sit and watch if real estate values start to falter or will he sell out and take his profits? Will foreign central banks sit on their dollar reserves if the dollar continues to decline in value or will they sell too? Or will they “diversify” their reserves as the Korean Central bank just announced they are going to do?

We are reaching an important inflection point in the economy and the stock market. The market has been rising since the start of the Iraq war in 2003. It's been rising because of low interest rates, low taxes, and government stimulation of the economy through debt. The DOW made a new 52-week high last week, real estate stocks are in the processing of making a climatic final rally, while the dollar is poised to break below 80 later this year and Gold is preparing to launch wave two of its bull market.

And don’t forget about the bond market. Long-term bond yield’s have been falling for six months despite the Fed's tightening cycle. One would expect bond yield’s to be rising. As Alan Greenspan has noted:

“This development contrasts with most experience, which suggests that, other things being equal, increasing short-term interest rates are normally accompanied by a rise in longer-term yields…. Some analysts have worried that the dip in forward real interest rates since last June may indicate that market participants have marked down their view of economic growth going forward, perhaps because of the rise in oil prices. But this interpretation does not mesh seamlessly with the rise in stock prices and the narrowing of credit spreads observed over the same interval…. For the moment, the broadly unanticipated behavior of world bond markets remains a conundrum. Bond price movements may be a short-term aberration, but it will be some time before we are able to better judge the forces underlying recent experience.”

I have made comments to the effect that the bond market is confusing to me. It makes no sense for bond yields to be so low when the inflation rate is around 3 ½%. However, William Fleckenstein, of fleckensteincapital.com, has given the best reason for why this is happening. He writes:

“It appears to me that bonds are making a giant, multiyear top (where day-to-day action doesn't make much sense), in the same way that bond yields took forever to come down in the early '80s, even as we were doing everything right (from a lower-bond-yield standpoint). I'll still never forget seeing mortgage rates back up to about 14% in the spring of 1984, due to huge inflation fears that were completely unfounded at that time.”

“Likewise, it makes no sense to see the 10-year note hovering around 4% today, given the understated nature of inflation, our burgeoning deficit, and the precarious nature of the dollar. But after a 25-year bull market in bonds, perhaps the top just takes time, in the same way that after a 40-year bear market in bonds, the bottom took a long time to flesh out. In any case, I think that interest rates are going higher in this country, even as the economy slows down, because of what I expect to happen in the currency market ultimately.”

Bonds have been in a secular bull market for over 18 years. It takes time for such markets to come to an end and change trend. They rarely turn on a dime and the bond market is a 50-pound elephant. However, we are on the verge of seeing major secular trends change in the dollar and the bond market. That is why I call the current environment a major inflection point.

Before the year is over, I expect to see the bond market begin a bear market, with bond yields rising over the next 5-10 years along with growing inflation, higher commodity prices (the CRB just made a new 52 week high last week also), and a falling dollar. We have seen the dollar decline for the past 2 ½ years, but we have not yet entered a major secular bear market for the dollar. For that to happen the dollar is going to have to break its 30 years support level of 80.

Such an event would be the most important move in the world financial markets of the year. It would be the start of a major trend, as important as the DOW breaking out to a new high in 1982 after having gone sideways through the previous decade. Such a move would eventually tip the bond market and would take the real estate market down with it.

http://wallstreetwindow.com/housing.htm

This comment has been removed by a blog administrator.

omar, all of your posts will be deleted. go spam someone else's blog with your real estate promotion sewage.

This comment has been removed by a blog administrator.

keep your costa rica crap off my blog!

Post a Comment

Subscribe to Post Comments [Atom]

<< Home