1995 Sonoma in the Tank

Thank you MoonValley for taking us back in time and showing us a little glimpse of history. History is on the verge of repeating itself, and you know what they say... Those who refuse to learn from history are doomed to repeat it.

Don't forget to check out the weekend's: Open Mouthed @ Open House

9 Comments:

well, there's plenty more where that came from as soon as my digital camera batteries re-charge..including snaps of your favorite RE Agents, the way they were.... Maybe we should have a new RE channel.....RE1...Behind the Sales.

Yeah, yerah and those damn 100 fruit trees will only drop messes on the Lexus, better to rip 'em out and get some cash flow positive condohotels slapped up before the opportunity is gone forever.

More horse puckey scare tactics from the NAR.

I especially love the bit about the rising housing prices driving up rentals:

"•Rising home prices. From 1980 to 2000, the median price of a home was 12 times higher than the annual average rent. By this spring, it was 21 times higher, Nadji said. The median-priced home now costs $223,000, making the American dream a fantasy for more renters, whose competition for apartments then drives up rents. There's little relief in sight in such areas as Phoenix and South Florida, where home prices soared more than 30% in the first quarter of this year over the same quarter last year.

• Condo conversions. When the housing market was at its blazing peak, many investors who owned apartment buildings kicked out tenants and sold the units as condos. One out of three apartment buildings sold last year were converted into condos for sale. That took 191,400 apartments off the market, according to the NAR. In addition, the number of new apartment buildings under construction is down this year."

What they're not talking about is the large number of vacant condos, that the flippers and builders have failed to move. I'm old enough to remember back the last time when all those condos turned into "apartments" all of a sudden and the landlords were falling all over themselves to lure tenants. I owned the house I was living in at the time but I saw it all around me..and this was in the most desirable area of LA..Santa Monica, and the Westside.

I do have to add that the only reason I have these magazines is my obsession with coming back home to northern Ca, also yes, I'm a packrat.

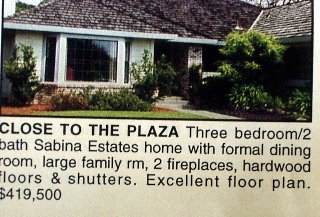

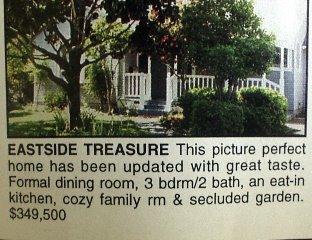

Since we just moved into our new house (rental) and we're combining things from our old (owned) house in Santa Monica, and our old (rental) in Sonoma these things have been in storage in the garage. I was shocked as hell when my husband brought them into our office and dropped them on our desk in front of me. I'd forgotten about them entirely. I may run across more as we continue to delve into dusty boxes. There are more pictures and pleading RE ads coming soon.

Eastside 3BR/2BA, 1/2 acre, pool, etc. = $387K? Wouldn't that list for $1-1.3M today? If true, that's steeper appreciation than Marin.

reskeptic, absolutely it would list for at least that.

the home my parents bought on wildwood ave in piedmont in 1957 for 16k sold for 48k in 1976 when they divorced,my father,an appraiser,was very pleased with the appreciation,with reason.a three fold appreciation in 19 years,and people now think anything less than 10% annually is bad! this correction is going to be something to see,i expect a correction to historical valuations as measured by median income/median price,inflation plus 1% annual appreciation,and rental multipliers of 6-10 for annual rents.interestingly these all give very similar values...at between 25% and 40% of current prices,depending on property type and location.and moonvalley,the nar will soon reach a level of credibility that is historically unsurpassed,and may never be reached again in human history...consider that at least 10% of our population is seriously mentally disturbed...and that only 7% of the population trusts realtors!

25-to 40% of current assessed value??? OMG!

My parents bought a house in San Francisco in 1952 for 10k. They wound up paying it off over 30 years then sold it in 1982 for 175k. They were able to buy a house in Sonoma with money left over and at 175k they really thought they were getting the best of the buyer. Meanwhile today the houses on their street are going for the mid 800ks to almost 1m. Go figure. I don't have the heart to tell them, when they say.."it must be worth at least 400k now!"

no moon valley,assessed value can vary widely from market value,as do the formulas for calculating it,and the tax rate...reading up on this stuff is a surreal experience for any reasonably rational person...the language used is essentially a form of thieves cant...as is so common among the newer "professions"

Post a Comment

Subscribe to Post Comments [Atom]

<< Home